QuickBooks Online, an online accounting tool released by Intuit in 2000, has provided a new pathway for small companies to manage their accounts.

Owners of small companies with very little or no knowledge of financial account management immediately got attracted to QuickBooks online once it was created. The software’s user interface, pricing, and popularity among professionals have been significant in its success.

The most prominent feature of Quickbooks online is the availability and accessibility of financial data anytime and anywhere. Ensuring smooth and hustle-free transactions and invoices has always been challenging.

The tool gives access to users with cash flows, revenue generation, and a clear understanding of the company’s financial position. The pricing for each plan varies between 30 dollars to 200 dollars per month. Let’s start to learn the advantages and disadvantages of QuickBooks online.

Competitors of Quickbooks online

Here are the main Quickbooks online competitors:

- Xero

- NetSuite

- Sage Intact

- FreshBooks

- Zoho Books

Advantages and Disadvantages of Quickbooks Online

There are many pros and cons of QuickBooks online we will look at them here. There are some Other Offerings by QuickBooks Online are:

- QuickBooks Payroll

- QuickBooks Commerce

- QuickBooks Live

- QuickBooks Time

- QuickBooks Payments

Let’s start with the Advantages of Quickbooks Online first.

Advantages of Quickbooks Online

As a cutting-edge accounting tool, QuickBooks Online distinguishes itself and offers several appealing advantages.

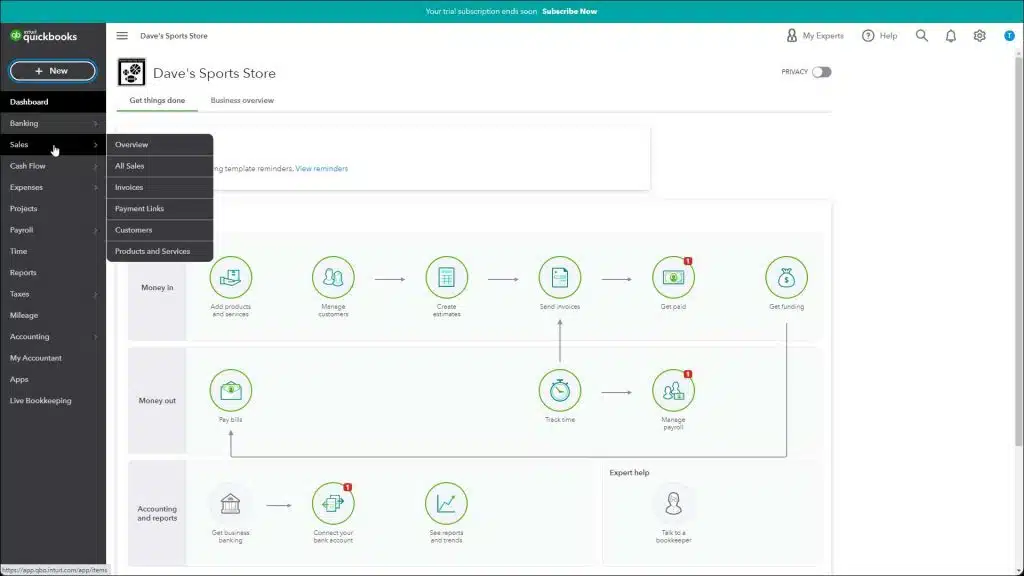

1. User Interface

The application is well-designed and modern, and it easily introduces users to the required functionality without needing prior knowledge. This is advantageous not only for new clients but also for classic desktop versions.

This feature distinguishes QuickBooks Online from other similar products, making it the best alternative for businesses seeking simplicity and efficiency in financial management.

2. Customizability

Quickbooks Online helps you successfully and rapidly manage and personalize your business’s financial details and readily obtain the information you require. You can avoid combing through insignificant data by developing reports tailored to your needs.

Instead, view personalized reminders to learn more about your business’s financial status. With this level of personalization, you receive the information you require exactly when you require it, allowing you to manage your company’s finances and make sound choices.

You may now quickly acquire critical information without having to navigate through traditional websites.

3. Regular updates with new features and adaptability

A significant advantage of QuickBooks Online is the availability of free upgrades, ensuring continuous access to the latest software updates.

All the latest advancements of QuickBooks Online effectively address the customers’ concerns by introducing impressive new features, taking note that the user interface and adaptability are not affected.

Significant upgrades include mileage tracking and batched transactions, and it utilizes artificial intelligence for automation. As a result, the solution becomes more dependable for specific sectors that often need help finding access to certain accounting features within popular applications.

4. Integrations

One of the great QuickBooks online benefits is integration. QuickBooks Online offers seamless integration with various third-party applications and services.

Thanks to this distinctive functionality, clients may easily link their accounting software with several business tools, such as payment processors, inventory management systems, and e-commerce platforms.

QuickBooks Online improves operations and removes the need for manual data entry, saving a substantial amount of time and reducing mistakes due to its seamless integration with these external technologies.

5. Shared Data Access

You’ll like how the QuickBooks online program functions if you delegate accounting tasks for your company to others. You only need a login and password to access the program because it is cloud-based.

This implies that anybody in the organization with the necessary credentials may access and use the program; they do not need to be using the computer you are using.

6. Backups on Your Office Computer are not required

You always worry about data loss when using other QuickBooks programs. The potential exists since it is initially saved on your computer and has to be backed up to your server. You risk losing this crucial information if something goes wrong with your desktop.

That’s fortunately not a concern with QuickBooks Online. The program automatically backs up everything for you, and Intuit’s servers are where all of your company’s financial data is kept.

7. Saves time

QuickBooks Online improves operations and removes the need for manual data entry, saving a substantial amount of time and reducing mistakes because of its seamless integration with these external technologies.

8. Use of the same profile

QuickBooks Online allows several users to obtain the same profile at the same time. This function is especially useful for firms with a team of auditors or accountants who need to collaborate in real-time.

It simplifies collaboration and guarantees that everyone possesses the most recent financial data.

9. Data Security

QuickBooks Online uses enhanced security techniques to safeguard financial information. It protects your information with encryption mechanisms, and Intuit periodically backs up your data to prevent loss in a technical failure.

They have strict privacy measures to safeguard your sensitive data from unauthorized access.

10. Scalability

Whether you are a solopreneur or running a growing company, QuickBooks Online can grow with you. Upgrade your subscription package to support more users, operations, and features.

This adaptability enables you to adapt the program to new business requirements without interruption.

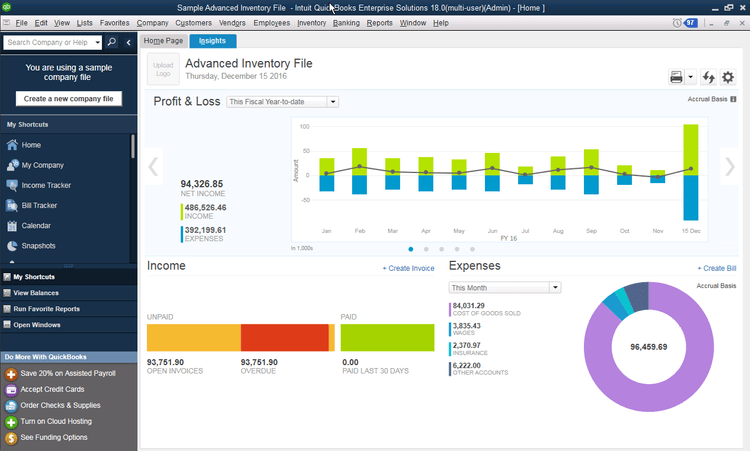

11. Reporting and Insights

QuickBooks Online includes a variety of reporting options to assist you in acquiring insights into the financial health of your organization. Customizable reports include financial statements, balance sheets, cash flow statements, and various other documents.

These reports allow you to make informed business decisions, track key performance metrics, and discover areas for development.

Disadvantages of Quickbooks Online

If we look at ERP software, Customer Relationship Management, SAP, or any other software they have their own pros and cons.

No one is perfect. Some have cost issues, some need more technical staff to understand and others may have limitations. Let’s look at the drawbacks of QuickBooks online.

1. High Cost

Although QuickBooks Online has many capabilities, keeping them up to date could prove costly. For example, adding up to 25 people is possible for a cost, but this functionality is only offered in the top-tier pricing plan, which may cost up to six times as much as the basic plan.

Users who want to save their books without incurring significant costs may have accessibility concerns due to this price system. The additional fees that QuickBooks Online charges for platform add-ons can dramatically raise the overall cost of utilizing the service.

These add-ons have their costs, increasing the program’s price even more. It’s crucial to remember that you will only have access to some bespoke features and functions once you choose the most expensive plan.

These feature sets comprise critical elements like automated data backup, multi-user access, dashboards, tailored reports, and automatic approvals.

2. Security and Privacy Issues

Users must give access to some information when switching from QuickBooks Desktop to Online. Although you cannot manually upload data to the QuickBooks Online servers, you may generate corporate files and submit them to QuickBooks Online, which will load them for you.

This may not be satisfactory as financial and accounting data is particularly private and sensitive. Since QuickBooks Online stores data in the cloud, it is exposed to the typical risks associated with online accounts.

These risks include potential threats from hackers seeking unauthorized access to sensitive information or disruptions caused by unreliable internet connections.

3. Inability to Restoring the Older Version

The capability of QuickBooks Online to roll back to a previous version of your books is one area where it needs to improve.

You won’t have the choice to return to a point when the most current transaction data was accessible unless you are utilizing QuickBooks Online at its highest costly tier or level.

This restriction is attributable to QuickBooks Online’s cloud storage and management paradigm, which updates and saves data without creating recovery points. As a result, It becomes difficult to go back to changed or deleted transactions.

Users have two alternatives to replicate these transactions: manually enter them or upgrade to the Advanced plan, which provides routine data backups.

4. Payment Issues

It’s important to note that not all banks enable smooth transaction downloads. While most national banks provide no problems, some local banks cannot offer suitable feeds.

Continuous transaction downloads may be delayed, or further security procedures may be required, such as supplying more information in response to bank security questions. The billing structure of QuickBooks Online is yet another area for improvement.

For instance, the transaction charge for payments made using invoiced cards is 2.4 percent, whereas the rate for payments made with swiped cards is higher at 3.4 percent.

These expenses are comparatively more significant than many contemporary payment processors, which can affect companies that depend heavily on card payments.

5. Internet Dependency

You need a dependable internet connection in order to use QuickBooks Online. You might require assistance to use the site effectively if you are experiencing internet issues or sluggish access.

6. Limited Customization

When compared to QuickBooks Desktop, QuickBooks Online provides fewer customization choices. While it offers a variety of features and operations, certain organizations with complicated accounting requirements may need more flexibility.

7. Learning adjustment

QuickBooks Online, like any other accounting software, has an adjustment curve. If you and your coworkers are unfamiliar with the software, it may take some time to become acquainted with its interface and functions.

Although training and support are provided, the early learning phase can have a temporary impact on production.

8. Server issues

Because QuickBooks Online is a cloud-based solution, there is a slight risk of service outages or unavailability. If the servers that host QuickBooks have technical problems or regular maintenance, accessibility to the software may be temporarily restricted.

Quickbooks Online Vs Quickbooks Desktop

| Quickbooks Online | Quickbooks Desktop |

| QuickBooks Online, a cloud-based accountancy program, online. | QuickBooks Desktop is more conventional accounting software you can download and install on your PC. |

| Businesses that want real-time collaboration and access to their QuickBooks files from any device should use QuickBooks Online. | Businesses that are familiar with accounting and don’t require real-time cooperation should use QuickBooks Desktop. |

| Robust mobile application. | Limited Desktop mobile application. |

FAQs

Which 3 are the benefits of using apps with Quickbooks online?

- Streamlined Workflows: Workflows may be made simpler by utilizing apps with QuickBooks Online to automate operations and integrate data from many platforms. The amount of manual data entering is reduced while efficiency is raised.

- Added Features: Apps provide extra features that can expand QuickBooks Online’s functions. They can give specialized capabilities like enhanced inventory management, project management, or time monitoring for specific sectors or company requirements.

- Customization: Using apps, users may modify and enhance QuickBooks Online’s capabilities to meet their unique needs. They provide a variety of choices to allow users to customize the program to meet their business needs, making it expandable as the company expands.

What are the limitations of using QuickBooks?

A few of QuickBooks Online’s limitations include its constrained data storage capacity, lack of sophisticated reporting options compared to QuickBooks Desktop, restricted access during internet outages, and the inability to customize some functions completely.

Furthermore, companies requiring considerable customization options or those with complicated inventory management requirements could find QuickBooks Online unsuitable.

What is the importance of using QuickBooks?

- Tax preparation becomes more accessible and less prone to errors because QuickBooks automates tax computations and provides tax reporting tools.

- The software integrates tasks such as payroll, payments, and invoicing to streamline company processes and boost output.

Final Words

After a detailed discussion, it has been evident that QuickBooks Online provides various benefits that contribute to making it an increasingly common option for startup companies and individuals seeking effective and user-friendly accounting software.

Its user-friendly design, available from any device with an internet connection, configurable reports, collaboration tools, frequent upgrades, and integration capabilities all give substantial benefits for properly managing financial data.

In addition, QuickBooks Online prioritizes data protection and scalability, allowing organizations to grow and adapt.

While there are certain drawbacks to be aware of, such as a dependence on the internet and restricted personalization choices, QuickBooks Online’s advantages make it a swift tool for managing financial responsibilities and receiving information about company operations.

We hope you enjoyed the pros and cons of QuickBooks online. If you need anything else let us know in the comment section.